The standard rate for each erosion is one half of the variance over time. However we erode the average return rate based on volatility. We find the periodic day of return for each day, we find the average of the periodic day of return.

In other words we take the historical closing price over a period of time such as one year or entire life of the asset. There are different theories for this, however for the purpose of standard Monte Carlo simulation we use a volatility eroded historical mean of the periodic day of return. The expected rate is the rate with the greatest odds of occurring. Let’s look at each of these for the drift we use the expected rate of return in another words we use the rate that we expect that to change each day.

#Monte carlo in excel average and standard deviation how to#

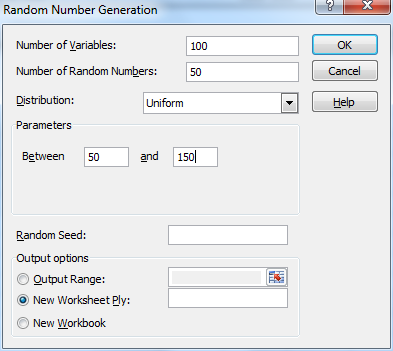

I begin by showing how to draw a random sample of size 500 from a \(\chi^2(1)\) distribution and how to estimate the mean and a standard error for the mean.In addition to keeping the above in mind, is also important to 1) be mindful of the shortcomings of your models, 2) be vigilant against overconfidence, which can be amplified by more sophisticated tools, and 3) bear in mind the risk of significant events that may lie outside what has been seen before or the consensus view.To create a Monte Carlo Simulator to model possible future outcome we need to find those two parts- the Drift and the random stochastic component. standard deviation - Required number of simulations for Monte The huge number of independent simulation threads allow FPGA-based simulators to be heavily pipelined, and also allow multiple simulation. As the name implies, this allows you to draw the distribution using a simple painting tool.np.ed(42)n_sims = 1000000sim_returns = np.random.normal(mean, std, n_sims)SimVAR = price*np.percentile(sim_returns, 1)print('Simulated VAR is ', SimVAR)Out:Simulated VAR is -6.7185294884And that’s it! Monte-Carlo simulations are a class of applications that often map particularly well to FPGAs, due to the embarrassingly parallel nature of the computation. To quickly illustrate a distribution as part of discussions or if you need a distribution when drafting a model not easily created from the existing palette, the freehand functionality is useful. Additionally, they can be used to estimate the financial impact of medical interventions.įreehand. Monte Carlo methods are also used in option pricing, default risk analysis.

Specifying the level of confidence we require for our mean estimate translates into a relationship between d, s, and n as you can see from Figure 1:In business and finance, most situations facing us in practice will lie somewhere in between those two. Home Monte carlo simulation mean and standard deviationįigure 1 shows the cumulative form of the Normal distribution for Equation (1).

0 kommentar(er)

0 kommentar(er)